The HOPE Insider is the name of our Quarterly Consumer Survey.

First-Quarter Survey Results

With Low Confidence, Clients Focus on What They Can Control

In 2025’s first-quarter results of Operation HOPE’s nationwide survey, The HOPE Insider, nearly 2,000 clients shared their sentiments on general economic conditions and their financial situations, as well as how the year’s start has gone under the new administration. Key findings show that participants feel anxious about their personal finances, have low confidence in the stability of the U.S. economy, but remain as hopeful as they were this time last year in their ability to improve their financial wellbeing over the course of the year.

here are five key findings

1. Rising cost of living plays a major role in low confidence in the economy

85% of clients have felt anxious about their personal finances since the beginning of the year and three-fourths are not confident that the U.S. economy will remain stable in 2025. Almost half are “unsure” that we’ll have good times financially over the next 12 months (46%), and 39% think we’ll have “bad times.”

A large portion of this unease comes from the high cost of living across the country:

- 81% of those working say they feel like their income is not keeping up with the rising cost of living

- Basic necessities have become more difficult to afford in the past three months:

- 60% say “food and groceries” have become more difficult for them to afford

- 51% say “housing (rent/mortgage)” has become more difficult

- 43% say “transportation (car, gas payments, public transit, etc.)” has become more difficult

2. Paycheck-to-paycheck living remains high

Nearly three-quarters (74%) of our clients say they consider themselves or their families to be living “paycheck to paycheck,” meaning they are not able to save money or plan for the future. Feeling like they can’t get ahead of their bills, almost half say it is a “bad time” to buy major household items (48%). Nearly half of participants (48%) say their personal debt levels have increased over the last 3 months. Of that debt, credit cards have continued last year’s trend as the most financially burdensome at 36%. Behind credit cards, the most stressful types of debt are student loans (16%), auto loans (12%), and mortgages (10%).

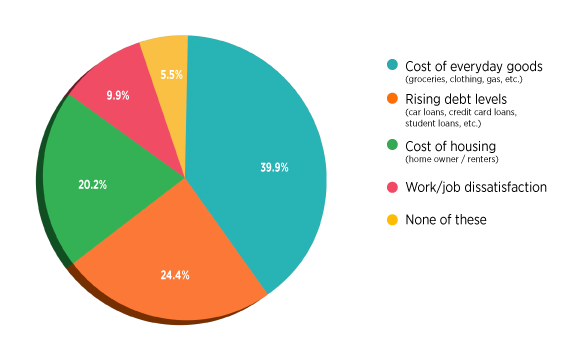

3. Rising debt levels—intertwined with cost of living—may be trending upward

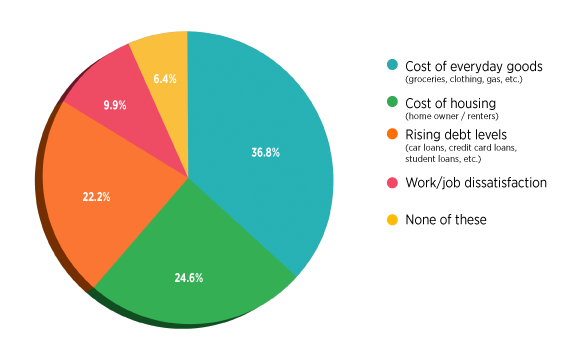

Although the cost of everyday goods is still the largest factor of impact and worry, the percentage of those who say it was the top factor this quarter are 40%—a six percent decrease from last quarter. Some of that share went to rising debt levels, at 24%, up from 20% last quarter. We will continue to keep an eye on this possible trend over the year.

Factor that most impacted life in last 3 months

Factor most worried about in next 3 months

4. Job situations remain stable, but satisfaction continues to decrease

Of those in the workforce:

- 69% of our clients say their job situation has remained stable since the beginning of the year

- 13% have been unemployed and actively looking for work

- 5% started a new job in the last three months

- 3% were laid off or furloughed

Last year we saw a ten-percent decline in those who are satisfied with their current employment (72% to 62%). This quarter continues that trend, with only 53% saying they are either “somewhat” or “very” satisfied with their employment. This may speak to the above sentiment that income is not keeping up with rising costs of living.

5. Hope remains strong as participants focus on managing their finances

Our clients remain most hopeful for the situations they can control: 80% say they are hopeful their financial wellbeing will increase over the next year and 81% are hopeful their work/career will improve. Hope in external factors—housing prices and the economic conditions for small business growth in their community—are lower but still significant, at 66% and 64%, respectively.